|

||||

|

In this Update:

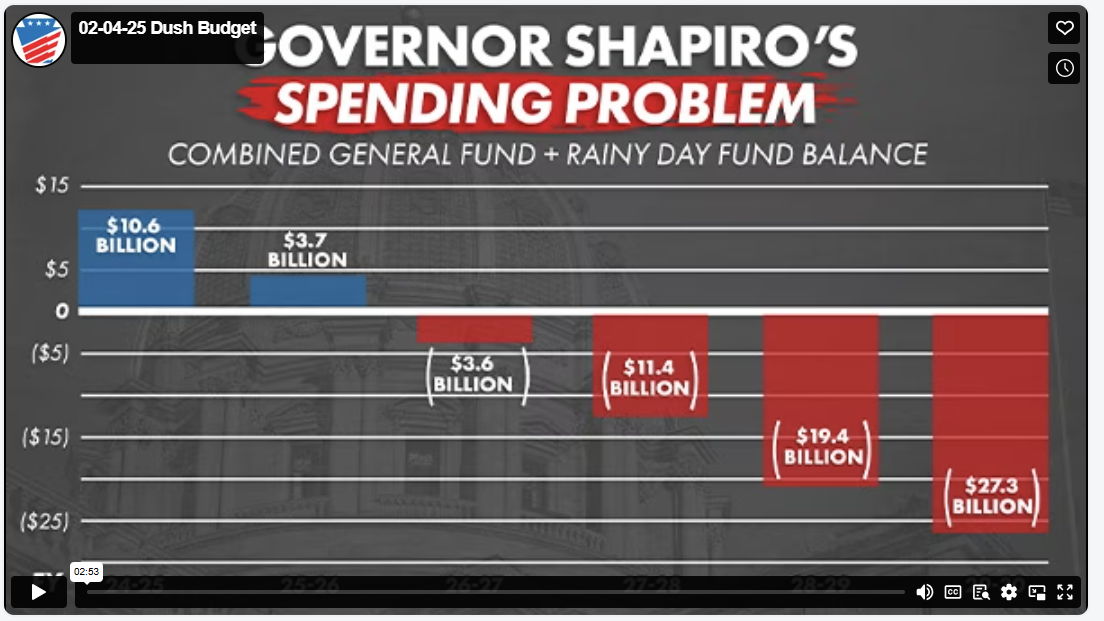

Shapiro Presents Unrealistic Spending Plan Featuring Multi-Billion Structural DeficitOn Tuesday, Gov. Josh Shapiro presented a $51.5 billion budget plan that would increase state spending by $3.6 billion, an increase of 7.5% compared to the current year’s budget. If left unchecked, the governor’s overly optimistic future revenue projections and wildly inaccurate future expenditure assumptions could eliminate the state’s emergency savings (also known as the Rainy Day Fund) and create the need for a multi-billion-dollar tax increase on Pennsylvania families within a year and a half. You can watch my comments immediately following the governor’s state budget address by clicking on the video link above. To put it bluntly, I have a plethora of disagreements with Shapiro’s proposed wrecking ball of a state budget. He is literally playing Santa Claus with a lot more unsustainable ideas about where to squander your hard-earned money. Once again, there are plenty of “I don’t know” answers, with no written plans coming from his executive branch secretaries on how to pay for it all. In reality, the governor is demanding that tax-paying “grown-ups” pony up for his reckless overspending. He’s also expecting the Legislature to reach into your wallets to pay for his empty promises. Whenever the governor is touting non-existing revenue streams, he’s even more rosy with his prognostications, such as his doubled-down estimates on proceeds generated from the improbable legalization of recreational marijuana and that taxing skill games will somehow generate five times more revenue than he predicted last year. In fact, Punxsy Phil has a far better rate of return on his Groundhog Day predictions, all without imposing or raising sin taxes on detrimental social vices. During the next five years, using realistic spending and revenue estimates, Shapiro’s spending plans would leave a $27.3 billion hole in the state’s finances. Pennsylvania has an unavoidable multi-billion-dollar structural deficit to close. We simply cannot sustain billions in new inflationary spending and tax increases when hard-working families are already struggling just to fill their gas tanks and put food on the table. As a member of the Senate Appropriations Committee, I will be participating in a series of state budget hearings to fully examine the governor’s proposal and identify fiscally responsible alternatives. The hearings will begin Feb. 18 and run through March 6. Please pray for us as we work through all of this to come up with a balanced budget that you can realistically afford while adequately funding core government functions that are truly needed. PA Senate Confirms Alfieri-Causer as McKean County JudgeCongratulations to Michele Alfieri-Causer, Esquire, who was officially confirmed by the PA Senate this week to fill the current judicial vacancy on the McKean County Court of Common Pleas. On Monday, I had the privilege of introducing her to my colleagues during the Senate Judiciary Committee confirmation hearing where she received a unanimous recommendation. With this appointment, Michele becomes the first woman judge in McKean County history. She is also the first woman to ever work in the McKean County district attorney’s office, and the first elected to serve as district attorney. Without question, Michele is a thoughtful, decisive, diligent, straight-shooter, and most importantly, a trailblazing public servant who cares deeply about the people in her communities. Bill Repealing RGGI Electricity Tax Receives Senate Support

To prevent a new electricity tax, the Senate passed legislation this week repealing Pennsylvania’s participation in the Regional Greenhouse Gas Initiative (RGGI). RGGI, a multi-state compact, would increase electricity rates for consumers, cut energy and manufacturing jobs and lead to the closure of Pennsylvania power plants. Senate Bill 186 would formally repeal Pennsylvania’s participation in RGGI, ensuring that any decision to impose electricity taxes or emissions programs must go through the legislative process rather than being enacted unilaterally by the executive branch. The bill now heads to the House of Representatives for consideration. Despite bipartisan opposition from the General Assembly, the Department of Environmental Protection and the Environmental Quality Board pressed ahead with regulations to establish a CO₂ Budget Trading Program – effectively imposing a tax on electricity generation. In 2023, the Commonwealth Court ruled that RGGI is a tax and cannot be implemented without legislative approval. However, Gov. Josh Shapiro’s decision to continue to appeal this ruling to the Pennsylvania Supreme Court has prolonged uncertainty for workers and businesses across the commonwealth and deepened concerns about energy grid reliability and affordability. Bill to Exempt Newer Vehicles from Emissions Testing Passes Senate

The Senate approved legislation this week to reform Pennsylvania’s outdated vehicle emissions testing program by reducing the number of vehicles covered by the requirement. The bill now moves to the House of Representatives for consideration. Currently, the federal Vehicle Emissions Inspection and Maintenance (I/M) program mandates that motorists in 25 Pennsylvania counties undergo annual emissions testing. Senate Bill 149 would exempt the five most recent model year vehicles from emissions testing requirements. The bill would align Pennsylvania with other states in the federally mandated Northeast Ozone Transport Region. Connecticut, Delaware, New Jersey, Rhode Island and Virginia have implemented similar exemptions with EPA approval. Recognizing National Cancer Prevention Month

February is National Cancer Prevention Month, an observance that aims to raise awareness about how impactful cancer can be for those who are affected and their loved ones. It’s also a time to celebrate the significant milestones people in treatment have achieved. While this legislative session has just begun, Senate Republicans last session passed landmark legislation that eliminated out-of-pocket costs for genetic testing of hereditary cancer syndromes and supplemental breast screenings for women at high risk of developing breast cancer. The law, which was the first of its kind in the nation, eliminated costs including co-pays, deductibles, or co-insurance for breast MRIs and ultrasounds for women with high-risk factors. It also eliminated costs for BRCA-related genetic testing and counseling for those women. Trout Stocking Schedule Announced

Local anglers can find out when their favorite fishing hole will be stocked with trout by the Pennsylvania Fish and Boat Commission using the annual Trout Stocking Guides available online now. The commission stocks approximately 3.2 million adult trout in nearly 700 streams and 130 lakes open to public angling each year. These figures include approximately 2.4 million rainbow trout; 693,000 brown trout; and 125,000 brook trout. The average size of the trout produced for stocking is 11 inches in length. Additionally, 72,000 trophy trout, sized from 14-20 inches, are 70% stocked before opening day. The statewide opening day for trout season is Saturday, April 5. Additionally, the Fish and Boat Commission will host Mentored Youth Trout Day on Saturday, March 29. Youth under the age of 16 can join a mentor (adult) angler who has a current fishing license and trout permit to fish for trout the Saturday before the regular opening days. Learn more about the program.

For anyone who hasn’t already signed up to receive my mission reports, you can get on the e-newsletter mailing list here. |

||||

|

||||

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://senatordush.com | Privacy Policy |