|

||||

|

In this Update:

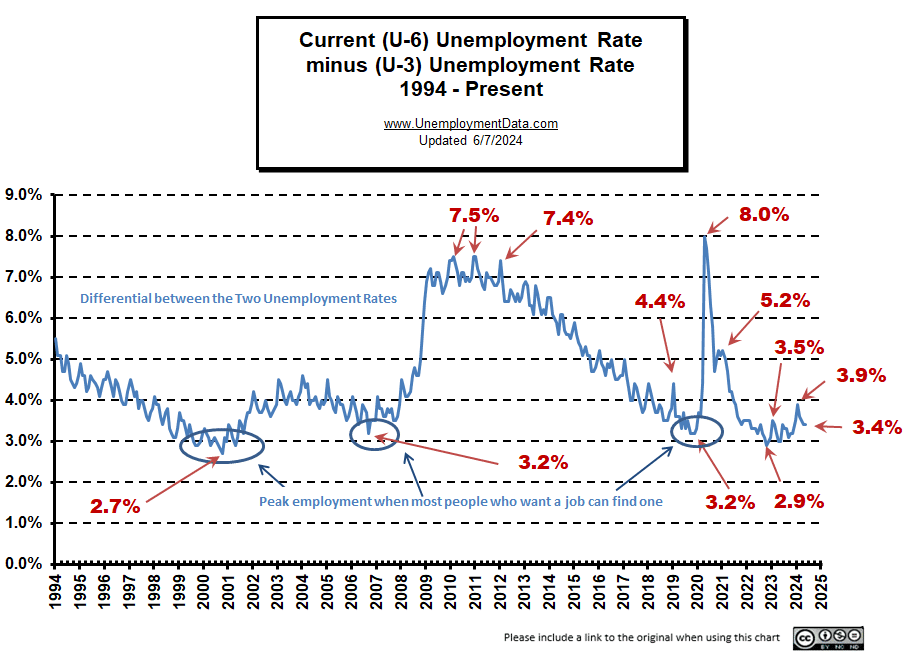

Promises Kept: Dush Votes No on Expanding Sunday HuntingThis week, I again honored my pledge to the citizens I serve by voting against further expansion of Sunday hunting across Pennsylvania. I’m going to go into some more detail about this issue because it generates strong feelings on both sides and a lot of second- and third-order impacts that are often not discussed due to the strong feelings on both sides. Although I love to hunt and love my fellow hunters, I also serve a larger population which does not do so. One of the contentions of those who support full Sunday hunting is the number of hunters increased after the 2019 law change that provided a few days of Sunday hunting. In analyzing the data, however, it becomes readily apparent that the bump in 2020 was largely due to people wanting to get out of being cooped up elsewhere because of the COVID lockdowns. The trend has again been downward since that time. What I have seen is a tremendous increase in the use of purple paint (indicating no trespassing) by property owners who want to have at least one day per week without someone on their property taking shots. That is land that had been open six out of seven days before. What I have heard from others who have chosen to not go that route is they will post their property against trespassing should they lose every day to hunting. Because of the loss of land access on posted properties, I now have hunters wanting the Pennsylvania Game Commission (PGC) and DCNR to purchase more land for state game lands and state forests. The shocking economic reality for rural Pennsylvania is there are now counties more than 50% owned by the Commonwealth, which creates a dramatic shortage in property tax revenue. PGC and DCNR pay only about $3/acre to the townships as payment in lieu of taxes. Losing that tax base causes significant loss to the townships. It also costs the hunters who are complaining to their township supervisors and me about the axle-busting roads that are impacting the residents who are using them. At a July 4th parade a gentleman who has a camp capable of holding well over 20 people informed me they only had a maximum of six during all of deer season last year. He attributes it to the loss of the family traditions that went along with what had been the Monday opening day to deer season. The reason I mention this is that those same hunters who pushed the opener to Saturday are behind the Sunday hunting. Another frequently overlooked aspect is the ever-increasing number of farmers, families and outdoor sports enthusiasts – who like to hike, ride their horses or whatever on private agricultural property or state forest land – that simply enjoy spending their Sundays without hunters. In spite of the opposition from those of us who have to deal with the second- and third-order impacts of this legislation, Senate Bill 67 was advanced for Pennsylvania House of Representatives consideration by a margin of 33-17. As a member of the Senate Game and Fisheries Committee, I have yet to see any convincing proof that fully imposing Sunday hunting will somehow increase or maximize the Keystone State’s abundant balance of outdoor economic and recreational assets. Inevitably, allowing MORE Sunday hunting will result in MORE posted land (permanently off-limits) to MORE Pennsylvania Hunters. Senate Approves Legislation to Capture “Real” Unemployment RatesOn Tuesday, my legislation to streamline the collection of more useful information and bring about greater transparency for the administration of Pennsylvania’s Unemployment Compensation program was approved by the Senate. Senate Bill 1177 would require the Department of Labor and Industry to include specific U-6 unemployment statistics in their annual Unemployment Compensation program report to the governor and the General Assembly. Currently, the Department only compiles data for those who are unemployed and actively seeking employment. Considered by many economists as the most revealing measure of “real” unemployment rates, the U-6 measures the percentage of the labor force that is unemployed, plus those who are underemployed, marginally attached to the workforce, and have given up looking for work. My legislation would further define these measures to ensure that they are calculated in line with federal standards. Under Senate Bill 1177, the Department of Labor and Industry would also be responsible for making this annual report publicly available on their website. Most importantly, adding these readily available U-6 statistics to Pennsylvania’s official annual Unemployment Compensation program report will allow policy makers, taxpayers and the media to more accurately monitor how these “real” unemployment rates change from year to year. Senate Bill 1177 is currently awaiting consideration in the Pennsylvania House of Representatives. Have Your Federal Government Questions Answered on July 9

On Tuesday, July 9 a representative from Congressman Glenn “GT” Thompson’s office will be working out of my Brookville district office, 73 South White Street, Suite 5, from 11:30 a.m. to 2 p.m. This is your opportunity to ask questions and express concerns with federal agencies such as the Social Security Administration, the Department of Veterans Affairs and the IRS. No appointments necessary. More than $5.1 Million in Impact Fees Distributed to Benefit District 25 Communities

Pennsylvania’s impact fee on unconventional natural gas wells will deliver more than $5.1 million benefiting communities in the 25th Senatorial District this year. At this point, I want to make something extremely clear: the impact “fee” is in fact a “tax” on our homegrown natural gas industry—which provides thousands of family-sustaining jobs— that was imposed before I was elected to the Pennsylvania Legislature. It is classified as a fee to ensure that “impacted” communities can more directly receive a significant portion of the tax to maintain or improve local infrastructure. More specifically, this revenue is another mechanism that enables our region to produce more of the energy our nation needs to heat and light up homes and businesses. Impact fees are levied in addition to regular business taxes paid by every corporation in Pennsylvania, including our natural gas businesses. The disbursements were based on a formula established in Act 13 of 2012 to ensure communities affected by drilling receive their fair share of funding for projects such as road and bridge repairs, housing and other infrastructure needs. The impact fee provides funding to the Commonwealth Financing Authority, which has generated more grants for the counties as listed below:

With this year’s statewide impact fee distribution total of almost $180 million, Pennsylvania has now realized, to date, more than $2.7 billion in impact fee revenues benefiting communities in all of the commonwealth’s 67 counties. To view detailed reports of the funding distribution, visit www.PUC.pa.gov. Work Continues on the 2024-25 State Budget

Our Senate Republican Caucus remains committed to producing a pro-growth budget which will empower Pennsylvanians and is equally honest with taxpayers about our state’s fiscal health both now and in the future. We have been diligently working to come to consensus on a final product. Additional session days will be added as needed to complete the budget as quickly as possible. I’m going to withhold some comments for now, because I want this year to go better than last year, but many of the frustrations I had last year are repeating themselves. What I will say is that under the Pennsylvania Constitution, the spending bills have to originate in the House of Representatives. The Senate has sent over most of what we have the capability to initiate but we have been waiting on the Democrat-controlled House to reciprocate. Learn more about the process of enacting the 2024-25 state budget and watch the Senate in session here. Bill Expanding First Responder Service Dog Fee Exemptions Receives Senate ApprovalThe Senate approved Senate Bill 82 to extend license fee exemptions to service dogs integral to fire departments, sheriff’s offices and rescue services. This exemption currently applies only to municipal and state police departments. The bill was sent to the governor to be signed into law. Service dogs detect threats, aid in search and rescue missions, and provide critical support during medical emergencies. The exemption from licensing fees aims to minimize financial barriers for agencies relying on these highly trained animals. Additionally, the measure addresses challenges created by a revision to the state’s dog law that prohibited out-of-state residents from boarding their dogs in Pennsylvania-based kennels. Senate Passes Bill Discounting Hunting and Fishing Licenses to Volunteer Firefighters

The Senate approved a bill that would enable volunteer firefighters to obtain discounted hunting licenses and fishing licenses in Pennsylvania. Resident adult hunting licenses cost $20.97 and fishing licenses cost $27.97. The legislation would reduce the cost of each to $1 for volunteer firefighters who served at least the previous 12 months in the commonwealth. Pennsylvania in the 1970s had as many as 300,000 volunteer firefighters. There currently are approximately 38,000 volunteer firefighters in the commonwealth.

For anyone who hasn’t already signed up to receive my mission reports, you can get on the e-newsletter mailing list here. |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://senatordush.com | Privacy Policy |