|

||||

|

In this Update:

Massive Spending Increase in Shapiro’s Budget Generates Major Inflationary ConcernsThis week, Gov. Josh Shapiro shared his proposed 2024-25 state budget, which includes an excessive $3.2 billion increase – a jump of 7.1% – in state spending. This level of increase will make it virtually impossible to balance future budgets without deep spending cuts and painful broad-based tax increases. If left unchecked, the governor’s $48.3 billion spending plan would completely eliminate the state’s current and future budgetary reserves in the next five years. You can watch my comments immediately following the governor’s state budget address by clicking on the video link above. The governor wants to dramatically increase state spending, which will lead to even greater inflation. We simply cannot afford billions in new spending and tax increases when hard-working families are already struggling just to fill their gas tanks and put food on the table. As a member of the Senate Appropriations Committee, I will be participating in a series of state budget hearings to fully examine the governor’s proposal and identify fiscally responsible alternatives. The first hearing is scheduled for Feb. 20. Do You Have Unclaimed Property?

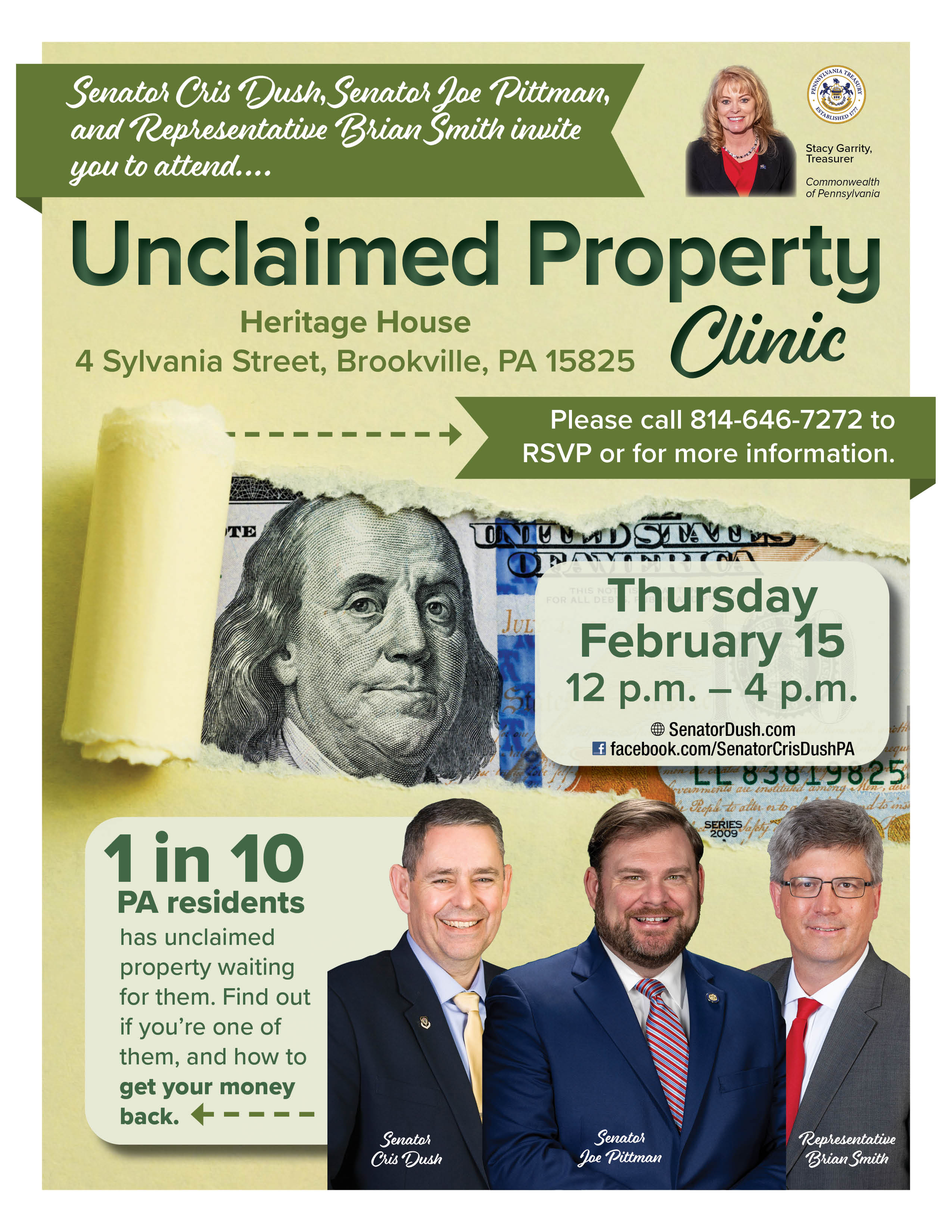

With the Pennsylvania Treasury holding more than $4.5 billion in unclaimed property, my team and I are partnering with Pennsylvania Treasurer Stacy Garrity and her office to help District 25 residents to determine if they have unclaimed property and, if so, help them claim it. On Thursday, Feb. 15, from noon until 4 p.m., a Pennsylvania Treasury Department representative will be conducting a free Unclaimed Property Clinic at the Heritage House, 4 Sylvania Street, Brookville, PA 15825. Unclaimed property can include dormant bank accounts, abandoned stocks, uncashed checks, saving bonds and other tangible assets such as collectible coins, sports cards, jewelry, military medals and antiques. More than one in ten Pennsylvanians is owed unclaimed property, and the average claim is worth about $1,600. During the last fiscal year, ending June 30, 2023, the Treasury Department returned the most unclaimed property ever in a single year – almost $274 million. Again, the fundamental reason my office is hosting this Unclaimed Property Clinic is to reconnect the citizens we serve with any money or other assets that rightfully belong to them. Best of all, you do not need to hire or pay anyone to make your claim. We always stand ready to assist you in navigating thru the entire unclaimed property process as this is already a free legislative service offered during regular district office hours. Individuals who wish to search the unclaimed property database on their own may do so at www.patreasury.gov. For more information or to RSVP for the Unclaimed Property Clinic on Feb. 15, please contact my Brookville district office at 814-646-7272. Securing State Borders Against InvasionThis week, I joined my Senate colleagues in passing a measure recognizing the rights of Texas and all other states to protect their citizens against invasion by foreign nationals who are illegally entering the United States. More specifically, Senate Resolution 234 voices support for the actions of Texas Gov. Greg Abbott to secure his state’s southern border against invasion amid federal inaction and unlawful interference from the Biden Administration. Since taking office in January 2021, President Biden has issued executive orders to suspend deportations, move financial resources away from border security initiatives and to end the successful “Remain in Mexico” policy. These executive orders are blatant violations of Article 4, Section 4 of the United States Constitution which stipulates that our government “shall guarantee to every state in this Union a Republican form of government and shall protect each of them against INVASION.” You can watch my floor remarks in support of Senate Resolution 234 by clicking on the video link above. Property Tax Relief is Available for Homeowners

Most homes and farms are eligible for property tax reduction under the Homestead Tax Exemption program. Under a homestead or farmstead property tax exclusion, the assessed value of each homestead or farmstead is reduced by the same amount before the property tax is computed. To receive school property tax relief for tax years beginning July 1 or Jan. 1, an application for homestead or farmstead exclusions must be filed by the preceding March 1. School districts are required to notify homeowners by Dec. 31 of each year if their property is not approved for the homestead or farmstead exclusion or if their approval is due to expire. Learn more and find an application.

For anyone who hasn’t already signed up to receive my mission reports, you can get on the e-newsletter mailing list here. |

||||

|

||||

2024 © Senate of Pennsylvania | https://senatordush.com | Privacy Policy |